The global/international/worldwide investment landscape is in a state of constant/rapid/dynamic change/evolution/transformation. Investors face/are confronted with/encounter a complex/nuanced/multifaceted array of opportunities/challenges/factors as they seek/strive/aim to maximize/optimize/enhance returns in an uncertain/volatile/fluctuating environment/market/climate.

- Key trends/Emerging themes/Driving forces shaping the future of investment include technological advancements/digitalization/innovation, shifting demographics/population growth/generational shifts, and growing geopolitical interconnectivity/tensions/risks.

- Furthermore/Moreover/Additionally, investors must navigate/address/contemplate environmental, social, and governance (ESG) considerations, increasing regulatory scrutiny, and cybersecurity threats.

To thrive/succeed/prosper in this complex/evolving/dynamic landscape, investors need to embrace/adopt/implement a proactive/strategic/forward-looking approach/strategy/framework. This involves/requires/demands diversification/asset allocation/portfolio construction, rigorous risk management, and a deep understanding/expertise in/knowledge of the underlying drivers/market dynamics/investment themes shaping the global economy/financial system/capital markets.

Investment Landscape Shifts: Prospects and Roadblocks

The dynamic global investment landscape presents both tremendous opportunities and complex challenges. Investors are targeting returns in a unpredictable market, driven by factors such as geopolitical instability. Developed economies offer promising prospects, while supply chain disruptions pose headwinds.

- Navigate effectively these trends, investors mustconduct thorough due diligence.

- Embracing innovation is vital for advancing in this complex environment.

Unveiling the Future: The Global Investment Outlook 2024

As we embark into the new year, the global investment landscape presents both exciting opportunities and {uncertainties|. The world economy remains in a state of flux, influenced by factors such as inflation, geopolitical tensions, and technological progress.

- Financial strategists are eagerly evaluating new avenues for growth, with a particular focus on sectors such as technology, renewable energy, and healthcare.

- Emerging markets remain to captivate significant {investment|, offering potential for {high{ returns but also presenting unique risks.

Navigating this complex landscape requires a strategic approach, with investors demanding to diversify their portfolios effectively.

Constructing a Diversified Portfolio in the Shifting Global Market

In today's fluctuating global market, investors are regularly seeking approaches to enhance their returns while mitigating risk. A well-diversified portfolio is regarded as the cornerstone of any successful portfolio.

Diversification consists of investing capital across a broad range of instruments, read more such as stocks, bonds, real estate, and alternative investments. This strategy aims to reduce the overall risk of a portfolio by offsetting potential losses in one sector with gains in another.

Moreover, diversification can enhance the potential for long-term growth by providing exposure to different market areas. As markets change, a diversified portfolio can offer a degree of protection and minimize the impact of recessions.

It is essential to periodically review and adjust a portfolio's composition in response to changing market conditions. A professional financial advisor can provide valuable insights to help investors reach their investment goals.

Investment Approaches for Sustainable Growth

Investors worldwide are increasingly seeking responsible investment options that align with their beliefs and contribute to a thriving future. This shift is driven by the growing awareness of the relationship between financial performance and environmental, social, and governance (ESG) factors|sustainability goals|corporate responsibility.

A core principle of global investment strategies for sustainable growth is diversification. This involves supporting a range of sectors and asset classes that demonstrate a commitment to sustainability.

- Renewable energy

- Impact investing

- Community development

It is vital to conduct comprehensive analysis to ensure that investments align with sustainability standards. By embracing these principles, investors can create positive social impact while contributing to a more sustainable future.

Unlocking Value in a Complex Global Investment Environment

Navigating the complex global investment environment presents numerous challenges for investors seeking to enhance value. Geopolitical uncertainties, volatile conditions, and rapid technological advancements create shifting landscape that demands strategic decision-making.

Successful investors must possess a deep understanding of global trends and the ability to predict emerging opportunities while mitigating risks. A balanced portfolio, coupled with rigorous due diligence, is vital for navigating this complex terrain and achieving long-term growth.

Additionally, investors must embrace a long-term perspective, recognizing that market fluctuations are commonplace. Patience, discipline, and dedication to their investment plan will ultimately shape success in this dynamic environment.

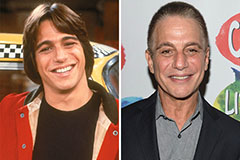

Tony Danza Then & Now!

Tony Danza Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Katie Holmes Then & Now!

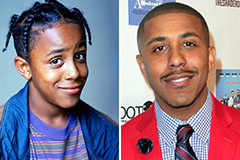

Katie Holmes Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!